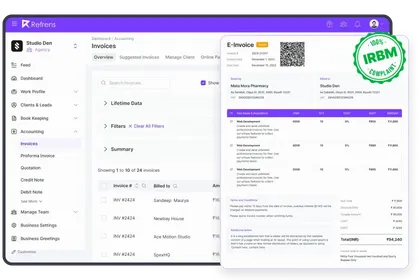

Key Features of Refrens E-invoicing Software

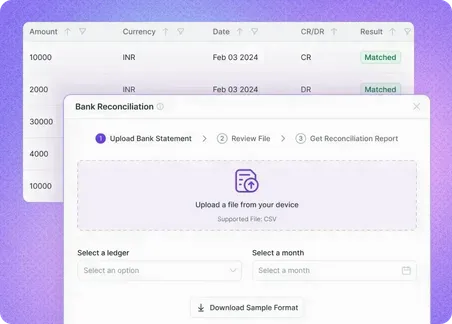

With Refrens, correcting or cancelling e-invoices is simple and fully aligned with MyInvois guidelines. Every change is properly recorded, validated, and synced with the tax portal, ensuring your accounting records and e-invoice data always stay consistent—reducing compliance risk.

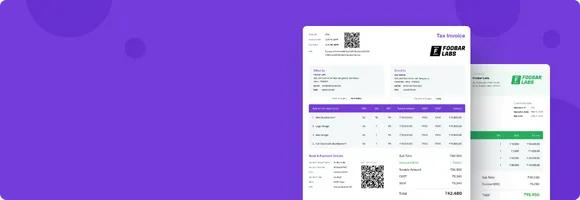

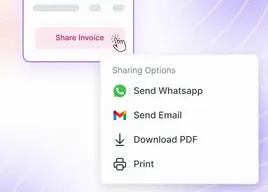

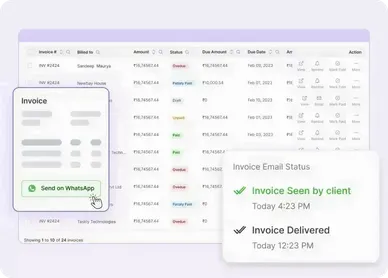

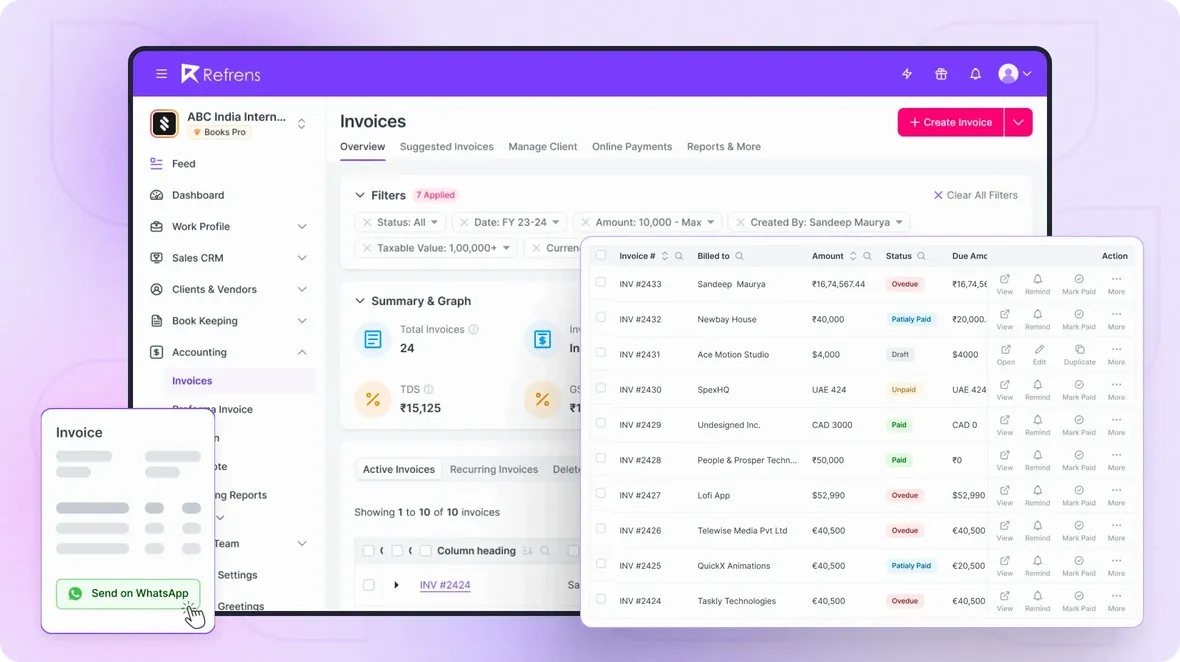

Refrens lets you share e-invoices via email, secure links or whatsapp in just a click. Each e-invoice includes all mandatory tax details, validation references, and QR codes required under Malaysia’s e-invoicing framework—so recipients receive complete, compliant documents every time.

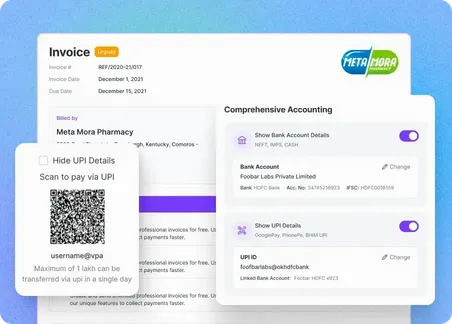

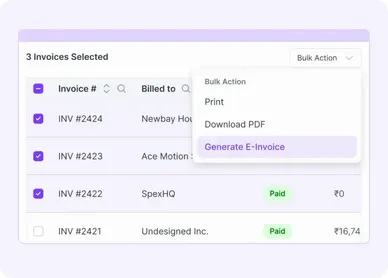

When suppliers are unable to issue e-invoices, Refrens helps you generate self-billed e-invoices effortlessly. Create compliant documents directly from your accounting data and submit them seamlessly to MyInvois—ensuring accurate reporting and zero manual work.

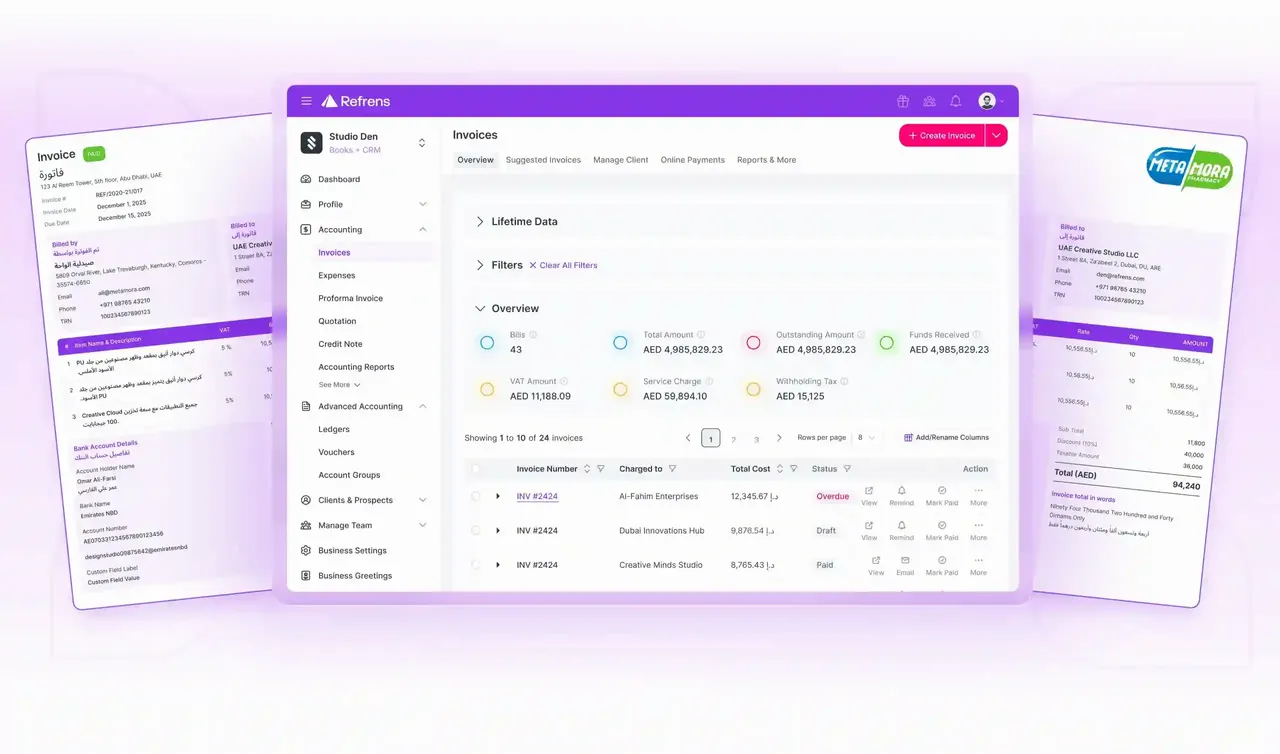

Refrens generates and submits e-invoices directly to MyInvois from the platform. The system validates data, applies the required formats, and ensures timely submission—helping you avoid delays, rework, and penalties.

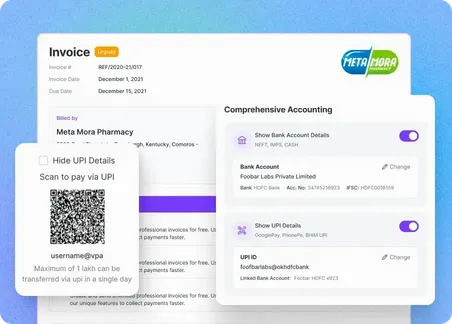

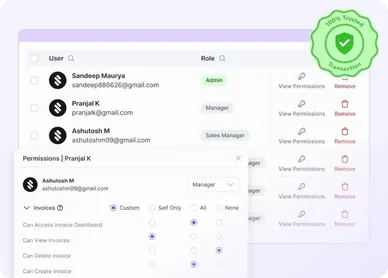

Refrens Accounting Software is designed to comply with MyInvois and MyTax standards. It ensures correct invoice structures, validation rules, audit trails, and reporting—so your business stays aligned with LHDN guidelines at all times.

Set up automated payment reminders linked directly to your e-invoices. Refrens sends timely reminders before and after due dates, helping improve cash flow while keeping your accounting records updated automatically.

Every e-invoice generated through Refrens includes an auto-generated QR code. Customers and authorities can instantly verify invoice details, validation status, and tax information—making transactions more transparent and reliable.

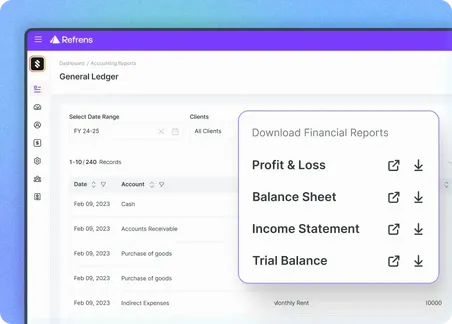

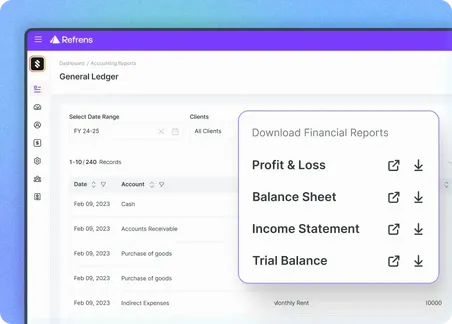

Refrens Keeps You Aligned With Government Data

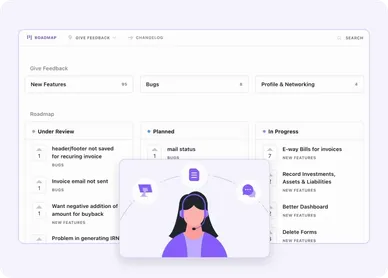

Why Refrens is the most trusted e-invoicing software in Malaysia?

Additional Features of Our E-Invoicing Software

Pricing of Refrens e-Invoicing software for Malaysia

Only Pay When You Need Premium Features.